Des Moines Elder Law Lawyer

An elder law lawyer in Des Moines, Iowa, can help you plan for your future. As we grow older, we grow wiser – but that doesn’t mean we don’t have any questions. “Who will take care of my family? And who will take care of me?”

Fortunately, an elder lawyer can be a valuable resource for information and answers to these important questions. Getting in touch with an established elder lawyer might be one of the smartest decisions you can make when it comes to making sure your future is planned right. It’s always important to have a reliable source of legal information if you’re planning out your estate – but an elder lawyer can do a lot more than just help you write up your will.

In fact, an elder law lawyer can ensure you’re looked after if you’re no longer able to take care of yourself, and they can also ensure anyone who was depending on you for care (elderly parents, young children, disabled adults) can be adequately looked-after if you’re no longer able to do so yourself. Reaching out to an elder law lawyer in Des Moines, IA, means much more than just planning your estate. It means planning your future, and providing a better future for those you care about.

Durable Power of Attorney

Do you have a plan for if you’re ever incapacitated, or unable to take care of yourself? An elder lawyer can help you prepare a durable power of attorney, and choose someone trustworthy that you can expect to adequately handle your personal, legal, and financial matters. A durable power of attorney also remains in effect if you’re ever mentally incapacitated, which makes it a reliable method of ensuring your estate is looked after, even if you’re no longer able to do so yourself.

If you’re concerned that you might not be able to adequately care for yourself, an elder law lawyer can help. And if you’re concerned that you might not be able to adequately care for someone else, an elder law lawyer can help with that, too.

Guardianship

No man (or woman) is an island. Chances are, you have close family members who need to be cared for, whether they are elderly parents, young children, or even disabled relatives. Taking care of them yourself is great, but what happens if you’re no longer able to provide the care they need? An elder lawyer can help you nominate a guardian to look after these family members.

A legal guardian takes up the responsibility for caring for people, but they can also take up the responsibility of caring for your estate. You might nominate a guardian to take care of your finances, and another to take care of your children. There are many different arrangements to guardianship, and it’s possible to have more than one single guardian appointed, depending on the situation. In any case, contacting an elder lawyer is the best way to decide who should be given guardianship, and when.

Contact Law Group of Iowa Today – and Plan for Tomorrow

At Law Group of Iowa, we care about giving you the best future possible. As we grow older, everyone always has important questions – and the right elder law lawyer can provide the right answers. We’re happy to provide any information about guardianship, durable power of attorney, estate planning, and anything else you might be wondering about: Get in touch, and see what a qualified elder law lawyer in Des Moines, IA, can do for you today.

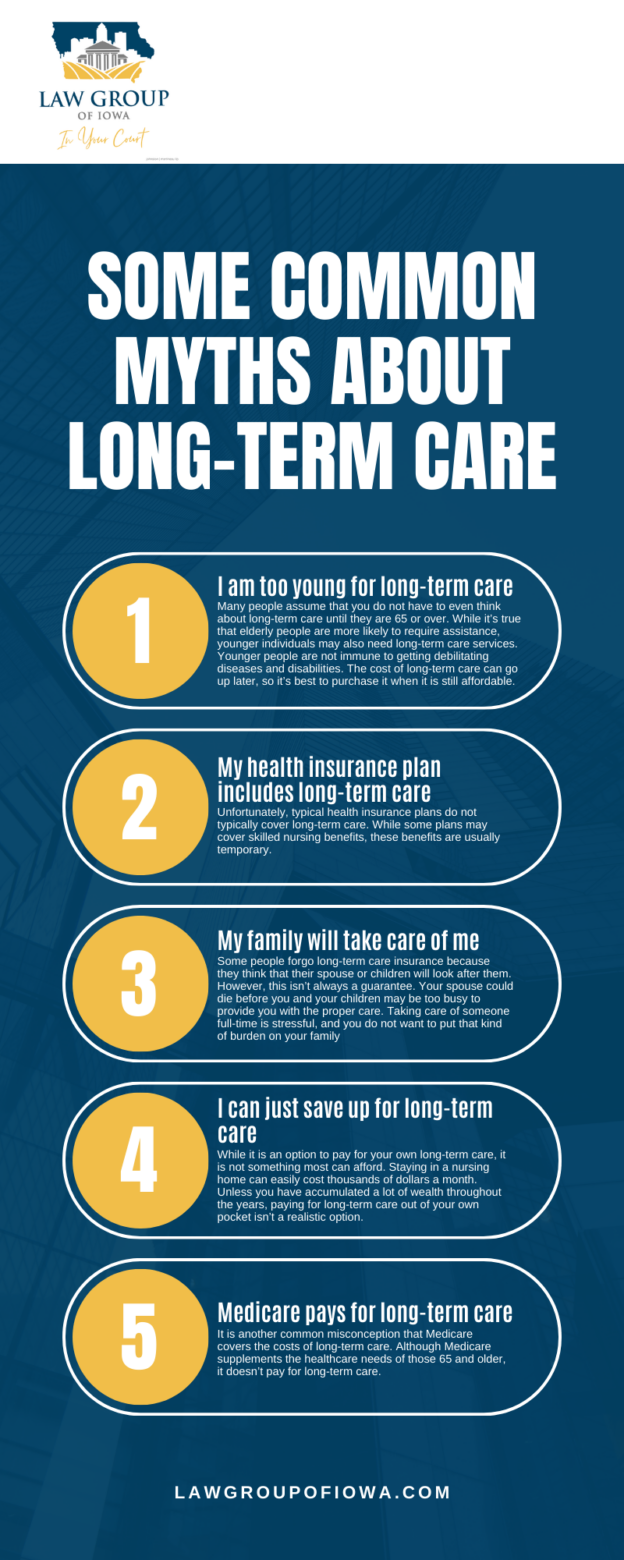

Common Myths About Long-Term Care

These days, people are living longer and longer. When many people reach a certain age, they may not be able to care for themselves anymore. They may need to move into a nursing home or have a home care professional come to their home. These long-term care options can get very expensive. That is why it is necessary to speak to an elder law lawyer in Des Moines, IA about long-term care insurance.

Here are some common myths about long-term care:

- I am too young for long-term care. Many people assume that you do not have to even think about long-term care until they are 65 or over. While it’s true that elderly people are more likely to require assistance, younger individuals may also need long-term care services. Younger people are not immune to getting debilitating diseases and disabilities. The cost of long-term care can go up later, so it’s best to purchase it when it is still affordable.

- My health insurance plan includes long-term care Unfortunately, typical health insurance plans do not typically cover long-term care. While some plans may cover skilled nursing benefits, these benefits are usually temporary.

- My family will take care of me. Some people forgo long-term care insurance because they think that their spouse or children will look after them. However, this isn’t always a guarantee. Your spouse could die before you and your children may be too busy to provide you with the proper care. Taking care of someone full-time is stressful, and you do not want to put that kind of burden on your family. If you have long-term care insurance, you will have a peace of mind knowing that you will be well taken care of in your older age.

- I can just save up for long-term care. While it is an option to pay for your own long-term care, it is not something most can afford. Staying in a nursing home can easily cost thousands of dollars a month. Unless you have accumulated a lot of wealth throughout the years, paying for long-term care out of your own pocket isn’t a realistic option.

- Medicare pays for long-term care. It is another common misconception that Medicare covers the costs of long-term care. Although Medicare supplements the healthcare needs of those 65 and older, it doesn’t pay for long-term care.

When you need an elder care lawyer in Des Moines, IA, look no further than the Law Group of Iowa.

Elder Law Infographic

Des Moines Elder Law Statistics

According to the U.S. Census Bureau, for the first time in American history, there will be more adults aged 65 and older than children. By 2060, nearly a quarter of Americans will be age 65 and older, while the number of people aged 85 and older will triple.

The aging of America means there will be an even greater need for assisted living facilities and nursing homes, which also means that many people’s finances will be vulnerable to being gobbled up by the high costs of these facilities. Don’t let that happen to you. Call an elder law lawyer for help.

Guardianships and conservatorships

Another issue that often comes up when dealing with the elderly is that of Guardianship or Conservatorship. These are designed to appoint someone to stand in for the elder person when they are no longer able to handle their own affairs. And sometimes the Conservatorship is aimed more at protecting the estate than the person.

Knowing if and when to create a Guardianship or Conservatorship can be tricky. For example, the elder may be able to care for themselves in their home, but are no longer able to handle their finances. If you’re an heir you may need to step forward to protect your rights. If you think you’re too young to consult an elder care attorney, you’re wrong. It’s totally acceptable to inform yourself well ahead of any need.

Consulting with an elder care lawyer in Des Moines, IA in advance of real need can make your life much easier. The Law Group of Iowa has both the knowledge and the experience to help you make the right decision and put it into practice.

Long term care facilities

If your elder lives long enough you may be faced with finding a nursing home. Many people aren’t aware that there is a middle ground, known as Home Based Community Services [HBCS]. In this case the elder stays in their home and receives the services they need. This can be a great answer to housing if it’s available in your Elder’s area.

In either case, both long term care and HBCS involve contracts. It can be helpful to have someone familiar with this kind of agreement to go over the paperwork with you and, if they can follow, your Elder.

The Law Group of Iowa is pleased to gift you with a free consultation about their services. Schedule an appointment with an email from our contact page and bring your questions. We’ll do our best to bring you up to speed about what you need to know about elder care law and how we can help.

Elder Law FAQs

When it comes to planning for your future or addressing legal issues that affect older adults, it’s important to understand how an Elder Law lawyer can assist you. At Law Group of Iowa, we’re committed to offering clear, straightforward guidance for those seeking help with Elder Law matters in Des Moines. Below, we’ve answered some of the most common questions we receive about this area of law, helping you make informed decisions for you and your loved ones.

What is the difference between a regular lawyer and an Elder Law lawyer?

The main difference between a regular lawyer and an Elder Law lawyer is the focus of their practice. While general lawyers handle a broad range of legal issues, Elder Law lawyers specialize in matters affecting seniors, such as estate planning, long-term care, guardianships, and Medicaid. Elder Law lawyers in Des Moines understand the specific legal challenges that seniors face as they age, and they provide tailored advice to address these concerns. While a regular lawyer can assist in many legal matters, an Elder Law lawyer is particularly skilled in navigating the issues that older adults are more likely to encounter.

When should I hire an Elder Law attorney?

It’s a good idea to consult with an Elder Law lawyer when you begin to plan for your future or the future of a loved one. This includes planning for long-term care, drafting a will or trust, or preparing for Medicaid. The earlier you work with an attorney, the better prepared you’ll be to handle future legal needs. Many of our clients reach out to us as they approach retirement, while others seek guidance when a loved one is facing serious health challenges. An Elder Law lawyer can help you make informed decisions before the need for action becomes urgent.

Can an Elder Law lawyer help with tax planning for seniors?

Yes, an Elder Law lawyer in Des Moines can assist with tax planning, particularly as it relates to seniors. This may include advising on how to structure your estate in a way that reduces tax liabilities, providing guidance on tax implications for inheritance, and helping you understand the financial aspects of Medicaid planning. By working with an Elder Law lawyer, you can ensure your financial planning takes into account the potential tax impact, helping you make the most of your assets and plan for the future more effectively.

How do I protect my assets from nursing home costs?

The cost of nursing home care can be overwhelming, and many seniors worry about losing their assets to pay for long-term care. An Elder Law lawyer can help you protect your assets through Medicaid planning, creating trusts, or exploring other legal strategies. These methods can help safeguard your savings while still qualifying for the benefits you need. By planning ahead with an attorney, you can ensure that your assets are protected from the high costs of nursing home care, allowing you to retain more of your wealth.

How can I avoid probate with the help of an Elder Law lawyer?

Probate can be a lengthy and expensive process that delays the distribution of your estate. One of the ways an Elder Law lawyer in Des Moines can help is by helping you create an estate plan that avoids probate. This can include setting up a living trust, adding beneficiaries to accounts, or making joint ownership arrangements. These strategies allow your assets to pass directly to your beneficiaries without going through the court system, saving time, money, and potential complications for your loved ones. An Elder Law lawyer can guide you in structuring your estate to avoid unnecessary delays and costs.

What should I bring to my first meeting with an Elder Law lawyer?

To make the most of your first meeting with an Elder Law lawyer, it’s important to bring any relevant documents that pertain to your financial and healthcare plans. This may include your current will or trust, health care directives, powers of attorney, and any documentation regarding your assets, income, or liabilities. The more information you provide, the better we can assist you in developing a plan that meets your specific needs. Feel free to come prepared with questions or concerns you’d like to address. At Law Group of Iowa, we want to ensure you feel comfortable and confident in your legal decisions.

If you’re looking for an Elder Law lawyer in Des Moines, the team at Law Group of Iowa is here to help. Contact us today to schedule a consultation and start planning for the future. We are committed to providing straightforward, professional guidance every step of the way.

Law Group of Iowa, Des Moines Elder Law Lawyer

5601 Hickman Rd #3b, Des Moines, IA 50310