An elder law lawyer in Des Moines, Iowa, can help you plan for your future. As we grow older, we grow wiser – but that doesn’t mean we don’t have any questions. “Who will take care of my family? And who will take care of me?”

An elder law lawyer in Des Moines, Iowa, can help you plan for your future. As we grow older, we grow wiser – but that doesn’t mean we don’t have any questions. “Who will take care of my family? And who will take care of me?”

Fortunately, an elder lawyer can be a valuable resource for information and answers to these important questions. Getting in touch with an established elder lawyer might be one of the smartest decisions you can make when it comes to making sure your future is planned right. It’s always important to have a reliable source of legal information if you’re planning out your estate – but an elder lawyer can do a lot more than just help you write up your will.

Table Of Contents

- Durable Power Of Attorney

- Common Myths About Long-Term Care

- Elder Law Infographic

- Guardianships And Conservatorships

- What Is An Elder Law Attorney?

- Finding The Right Elder Law Lawyer

In fact, an elder law lawyer can ensure you’re looked after if you’re no longer able to take care of yourself, and they can also ensure anyone who was depending on you for care (elderly parents, young children, disabled adults) can be adequately looked-after if you’re no longer able to do so yourself. Reaching out to an elder law lawyer in Des Moines, IA, means much more than just planning your estate. It means planning your future, and providing a better future for those you care about.

Durable Power of Attorney

Do you have a plan for if you’re ever incapacitated, or unable to take care of yourself? An elder lawyer can help you prepare a durable power of attorney, and choose someone trustworthy that you can expect to adequately handle your personal, legal, and financial matters. A durable power of attorney also remains in effect if you’re ever mentally incapacitated, which makes it a reliable method of ensuring your estate is looked after, even if you’re no longer able to do so yourself.

If you’re concerned that you might not be able to adequately care for yourself, an elder law lawyer can help. And if you’re concerned that you might not be able to adequately care for someone else, an elder law lawyer can help with that, too.

Guardianship

No man (or woman) is an island. Chances are, you have close family members who need to be cared for, whether they are elderly parents, young children, or even disabled relatives. Taking care of them yourself is great, but what happens if you’re no longer able to provide the care they need? An elder lawyer can help you nominate a guardian to look after these family members.

A legal guardian takes up the responsibility for caring for people, but they can also take up the responsibility of caring for your estate. You might nominate a guardian to take care of your finances, and another to take care of your children. There are many different arrangements to guardianship, and it’s possible to have more than one single guardian appointed, depending on the situation. In any case, contacting an elder lawyer is the best way to decide who should be given guardianship, and when.

Contact Law Group of Iowa Today – and Plan for Tomorrow

At Law Group of Iowa, we care about giving you the best future possible. As we grow older, everyone always has important questions – and the right elder law lawyer can provide the right answers. We’re happy to provide any information about guardianship, durable power of attorney, estate planning, and anything else you might be wondering about: Get in touch, and see what a qualified elder law lawyer in Des Moines, IA, can do for you today.

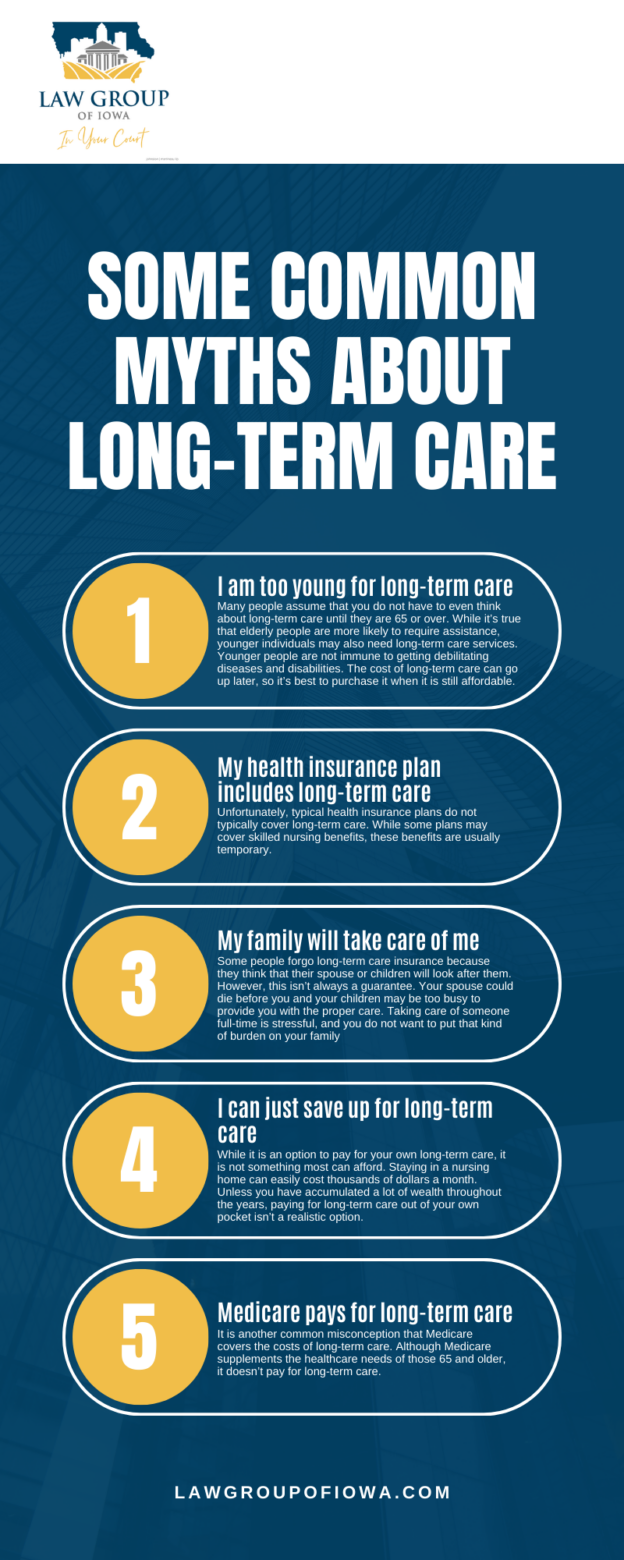

Common Myths About Long-Term Care

These days, people are living longer and longer. When many people reach a certain age, they may not be able to care for themselves anymore. They may need to move into a nursing home or have a home care professional come to their home. These long-term care options can get very expensive. That is why it is necessary to speak to an elder law lawyer in Des Moines, IA about long-term care insurance.

Here are some common myths about long-term care:

- I am too young for long-term care. Many people assume that you do not have to even think about long-term care until they are 65 or over. While it’s true that elderly people are more likely to require assistance, younger individuals may also need long-term care services. Younger people are not immune to getting debilitating diseases and disabilities. The cost of long-term care can go up later, so it’s best to purchase it when it is still affordable.

- My health insurance plan includes long-term care Unfortunately, typical health insurance plans do not typically cover long-term care. While some plans may cover skilled nursing benefits, these benefits are usually temporary.

- My family will take care of me. Some people forgo long-term care insurance because they think that their spouse or children will look after them. However, this isn’t always a guarantee. Your spouse could die before you and your children may be too busy to provide you with the proper care. Taking care of someone full-time is stressful, and you do not want to put that kind of burden on your family. If you have long-term care insurance, you will have a peace of mind knowing that you will be well taken care of in your older age.

- I can just save up for long-term care. While it is an option to pay for your own long-term care, it is not something most can afford. Staying in a nursing home can easily cost thousands of dollars a month. Unless you have accumulated a lot of wealth throughout the years, paying for long-term care out of your own pocket isn’t a realistic option.

- Medicare pays for long-term care. It is another common misconception that Medicare covers the costs of long-term care. Although Medicare supplements the healthcare needs of those 65 and older, it doesn’t pay for long-term care.

When you need an elder care lawyer in Des Moines, IA, look no further than the Law Group of Iowa.

Elder Law Infographic

Des Moines Elder Law Statistics

According to the U.S. Census Bureau, for the first time in American history, there will be more adults aged 65 and older than children. By 2060, nearly a quarter of Americans will be age 65 and older, while the number of people aged 85 and older will triple.

The aging of America means there will be an even greater need for assisted living facilities and nursing homes, which also means that many people’s finances will be vulnerable to being gobbled up by the high costs of these facilities. Don’t let that happen to you. Call an elder law lawyer for help.

Guardianships and conservatorships

Another issue that often comes up when dealing with the elderly is that of Guardianship or Conservatorship. These are designed to appoint someone to stand in for the elder person when they are no longer able to handle their own affairs. And sometimes the Conservatorship is aimed more at protecting the estate than the person.

Knowing if and when to create a Guardianship or Conservatorship can be tricky. For example, the elder may be able to care for themselves in their home, but are no longer able to handle their finances. If you’re an heir you may need to step forward to protect your rights. If you think you’re too young to consult an elder care attorney, you’re wrong. It’s totally acceptable to inform yourself well ahead of any need.

Consulting with an elder care lawyer in Des Moines, IA in advance of real need can make your life much easier. The Law Group of Iowa has both the knowledge and the experience to help you make the right decision and put it into practice.

Long term care facilities

If your elder lives long enough you may be faced with finding a nursing home. Many people aren’t aware that there is a middle ground, known as Home Based Community Services [HBCS]. In this case the elder stays in their home and receives the services they need. This can be a great answer to housing if it’s available in your Elder’s area.

In either case, both long term care and HBCS involve contracts. It can be helpful to have someone familiar with this kind of agreement to go over the paperwork with you and, if they can follow, your Elder.

The Law Group of Iowa is pleased to gift you with a free consultation about their services. Schedule an appointment with an email from our contact page and bring your questions. We’ll do our best to bring you up to speed about what you need to know about elder care law and how we can help.

Remember, When you need an elder care lawyer in Des Moines, IA, look no further than the Law Group of Iowa.

What Is An Elder Law Attorney?

This is a great question that a lot of people newer to estate planning, nursing home care, and Medicare/Medicaid, find themselves asking. Elder law as a field of law encompasses many different parts. So, to answer this question, it is best to describe the general goals and reasons people may seek out an elder law attorney.

First off, you don’t have to be elderly to go to an elder law attorney. Our expertise touches so many different areas of the law, that we are useful for things like developing wills, trusts, estate plans, and other documents and mechanisms for people of any age. Therefore, if you are in your 30s or 40s and wanted to protect your family, you would come see one of the attorneys at our firm for assistance.

So, what differentiates an elder law attorney from a typical trusts and estates attorney? As an elder law attorney, I am trained to help people accomplish more complex issues, such as nursing home care, Medicaid eligibility, Veterans Administration Benefits, protecting assets in special needs trusts, Miller trusts, tax issues, long-term care insurance, life insurance coverage, living wills, durable power of attorneys, and of course Medicare services. It is that suite of services that differentiates an elder law attorney from someone that just does wills or from someone who just does complex trusts.

Our clients tend to be divided into two categories: those seeking emergency assistance and those seeking estate and life planning advice. What is emergency assistance? Typically, clients require emergency assistance from an elder law attorney if they find that their loved one needs immediate or near-immediate intervention to place them into a nursing facility or a specialized nursing facility. That sounds strange at first, because shouldn’t the family know the needs of their loved ones? In a perfect world, yes. But, what if you only see your senior family members on holidays? It may come as a shock to you that they are eating expired food or misreading a food label or taking the wrong medications. Those are symptoms of dementia and Alzheimer’s disease which frequently take families by surprise.

In such instances, family members would seek out our services to assess, plan, and re-organize the loved one’s assets and income to make them Medicaid eligible for a nursing home as soon as reasonably possible. Iowa follows very strict guidelines. The application is typically between 63 and 170 pages and is complex—touching all aspects of the person’s life. A traditional Trusts and Estates attorney would not do such work. The attorneys at our firm work consider the many aspects of a person’s life to empower the family to make the best decisions for their loved ones.

Those that seek an elder law attorney on a non-emergency basis are instead trying to plan for the future. It goes without saying, you are never too young to plan. We will help to assess your needs and advice on how to protect your spiritual, financial, moral, and health needs. We do this through legal documents such as living wills, advanced directives, durable powers of attorney, etc.

Elder attorneys do so much and that was just the tip of the iceberg! Call us for a free consultation today!

What, exactly, is an elder care lawyer?

The obvious is true. An elder care lawyer specializes in the law concerning the elderly. Of course, there is no certain age when someone automatically becomes ‘elderly.’ As a general rule, people who are 65 or older are considered to be a ‘senior,’ but even that is a squishy definition. Looking at the services an elder lawyer provides may help. These include:

- Discussing with you your estate planning options

- Helping you to understand the importance of a will

- Discussing future planning for anyone who may have a disability or special requirements

- Explaining to you the probate process

- Drafting a durable power of attorney

- Drafting guardianship documents

- Help you to choose a legal guardian

- Help you to understand and draft advanced health directives

- Assist you with your insurance or Medicare planning

Obviously any of these issues may come up sooner than later, but this list gives you a sense of what elderly means in practice.

Do You Have To Be Elderly To Go To An Elder Law Attorney?

Absolutely not. Whether you are seeking out advice and counsel for yourself, your special needs child, your parents, or whomever may need guidance, the attorneys at Law Group of Iowa can help you.

How Can An Elder Law Attorney Assist A Young Couple With A New Baby?

If you are a young couple with a new baby, you have a lot of things on your plate. While figuring out disposable versus cloth diapers, remember that your baby’s future starts today. An elder law attorney can help both the parents and the child to start their futures on the right foot. For example, will the baby require a special needs trust, a college fund, life insurance, specialized medical care, etc.? Have the parents planned for what happens in the case of their deaths or incapacitation? Does the couple need life insurance, a trust, a specialized method for protecting the equity in their home from liability? Will their home be covered by flood insurance? An elder law attorney can help this couple figure out all of those issues.

How Can An Elder Law Attorney Help A Mid-Career Professional?

You’ve made it, you’ve established yourself, and you don’t want to risk your future—that set of feelings is a great indicator that you need to see the elder law professionals at Law Group of Iowa. The services we provide for those that are millennials, Gen Xers, and other working age generations, we call life or future planning. We fully understand—you’re not elderly and you still have a lot of living to do. So how can we help you? Mid-career, you have accumulated assets, like a car, or a home; you’ve put away money into savings, and perhaps a retirement account; and your parents are starting to get older and you’re not sure will happen as they age. We can help to evaluate your assets and see how best to protect them from liability. We can look at your savings and see if you are doing all that you can to prepare for retirement. We can also help go over the steps for assisting your parents and loved ones.

How Can An Elder Law Attorney Help Someone Approaching Retirement?

There is a lot of work to prepare for retirement that raise a lot of questions. For example: What age should I retire at? When can I retire? How can I figure out if I have enough saved for retirement? IS it too late to take out life insurance? Do I need to invest more aggressively? Should I start looking at nursing homes? How do I prepare for a nursing home? Are there alternatives to nursing homes? Does Medicare pay for nursing home care? Does Medicaid pay for nursing home care? Do I need long-term care insurance? How do I get long-term care insurance? Can I pay someone to monitor my different accounts?

We will work with a team of experts to assess, plan, and execute everything necessary for you to achieve your goals. We have experience working with accountants, financial planners, Medicare experts, long-term care experts, and many other professionals.

How Is Law Group Of Iowa Different From Other Elder Law Practices?

We pride ourselves on working with reputable and well-established professionals. You are welcome to instruct the attorneys to work with any financial planning professional of your choosing. But, many people don’t have a dedicated accountant, financial planner, long-term care specialist, or Medicare expert. In that case, we will introduce you to a variety of professionals and make sure our office is a one-stop shop for your retirement planning. We don’t employ any other professionals, rather, we have created a flexible working environment to facilitate professional collaboration.

What Are Some Elder Law Issues To Consider For Your Future?

Let’s define the future a bit more clearly—in terms of elder law, the future means what happens after you reach a point where you require a material change to your living situation. What would be an example? The most common example is when you begin to require assistance for things like getting your groceries, maintaining your home, paying for power bills, driving with difficulty, or any other measurement of senility. This is not something to be ashamed of, but rather something to be planned for in advance. We all age and there is nothing we can do to hold off ALL of the ravages of time. But, with some good planning, we at Law Group of Iowa, can help your transition to a nursing home, specialized care facility, or even home-based community services, as easy as possible.

What Are Some Issues That An Elder Law Attorney Can Help A Person With In The Present?

People, whether they are elderly or not, require security in their income, assets, home, and health. The elder law attorneys at Law Group of Iowa help elderly clients and their families figure out the best formulation for protecting their assets in case of medical emergencies, illness, or other unforeseen events. In addition, we evaluate your needs to see how to maximize your opportunity for living your best life. Perhaps, you are eligible for VA benefits; perhaps there is a better Medicare supplemental plan available; or maybe there is an annuity that would better help to increase your income.

What Are Some Of The Legal Needs Of The Elderly?

The legal needs of the elderly can be divided into three distinct areas: 1) the present; 2) the future; 3) and after passing.

What Can An Elder Law Attorney Do Once It’s Time To Enter A Nursing Home?

We help people become Medicaid-eligible. Nursing homes are astronomically expensive. Self-pay can approach $20,000 per month. Self-pay means 100% of the cost of the nursing facility would come out of your pocket. To avoid that, we assist individuals and family members to become Medicaid eligible. Is this ethical? Very! In fact, the State recommends working with a professional to plan for such an eventuality. Over 75% of women and 50% of men find themselves in nursing facilities at some point in their lives.

When Is The Best Time To Meet With An Elder Law Attorney?

Yesterday. We work hard to shield your assets, protect your loved ones, and to enshrine your vision of tomorrow. Medicaid planning is by far the most intensive component of elder law, therefore, the sooner you meet with us, the more cost-effective and thorough the process will be. Planning for the future sooner rather than later avoids penalties and helps to reduce your future costs.

Why Are There So Few Elder Law Attorneys?

You can see from the above—there are a lot of moving parts. Attorneys tend not to be number crunchers—they tend to be wordsmiths. Successful elder law attorneys are the ones that can balance the complex math with the soft touch of working with families and case workers. Also, a lot of attorneys prefer to work under as few statutes as possible. Elder law requires working within both federal and state law—there are Medicare codes, Medicaid statutes, IRS provisions, estate-planning case law, and many other moving parts that turns many attorneys away from this field.

That’s why Law Group of Iowa is here! We take the anxiety and stress out of the many, many different steps to aging. We make a commitment to make your dreams our passion.

Finding The Right Elder Law Lawyer

It is critical to work with an experienced Des Moines, IA elder law lawyer that you can truly trust. Finding the right attorney should be taken very seriously, and at Law Group of Iowa, we handle each case with precision and care. Here are a handful of questions you should consider when hiring an elder law lawyer.

What qualifications should I consider when searching for an elder law lawyer?

When seeking an elder law lawyer, several key qualifications are crucial to ensuring you find a qualified professional who can effectively address your needs. First and foremost, prioritize a lawyer who specializes in elder law. Elder law encompasses a wide range of legal issues affecting seniors, including estate planning, Medicaid planning, guardianship, and more. Specialization ensures the lawyer has in-depth knowledge of the complex legal landscape specific to seniors.

How can I verify the experience and track record of an elder law attorney?

Experience is a critical factor in assessing the competence of an elder law attorney. Inquire about the lawyer’s years of practice in elder law, as well as their success stories in cases similar to yours. Look for reviews, testimonials, or case results that demonstrate their ability to navigate complex elder law matters successfully. Additionally, membership in relevant professional associations, such as the National Academy of Elder Law Attorneys (NAELA), can indicate a commitment to staying updated on current legal developments in the field.

What should I consider during the initial consultation with a prospective elder law attorney?

The initial consultation is an opportunity to evaluate whether the Des Moines elder law lawyer is the right fit for your needs. Prepare questions about your specific concerns, such as estate planning, long-term care, or veterans’ benefits. During the consultation, pay attention to how well the attorney listens, communicates, and explains legal concepts in understandable terms. An effective elder law attorney should exhibit empathy, patience, and the ability to tailor their advice to your unique circumstances.

What role does ongoing education play in the selection of an elder law lawyer?

Elder law is a constantly evolving field due to changes in legislation, regulations, and court decisions. Therefore, selecting a lawyer who demonstrates a commitment to continuous learning is vital. Inquire about the attorney’s participation in seminars, workshops, and conferences related to elder law. Staying up-to-date on legal developments is a sign that the lawyer is dedicated to providing accurate and informed advice to their clients.

How important is a strong network of professionals in evaluating an elder law attorney?

Elder law often requires collaboration with other professionals, such as financial advisors, social workers, and healthcare providers. A well-connected Des Moines elder law lawyer has a network of trusted experts to tap into for comprehensive support. During your search, ask the attorney about their working relationships with these professionals and how they leverage their network to provide holistic solutions. A lawyer who can coordinate efforts across disciplines can offer more effective guidance for your unique needs.

Don’t hesitate to contact our offices for a consultation today. We will thoroughly evaluate your needs and advise you and your family with prestige legal guidance.