Wills Lawyer Des Moines, IA

Your Dedicated Wills Lawyer

A will is definite peace of mind, and to many of us who spent a bit of time planning for the inevitable, we might think that our will is the end of the line. Our Des Moines, IA wills lawyer can help answer any questions you may have about your last will and testament—chances are, you’ve got a lot.

If you’ve already written up a will, great job: You’ve taken steps to make sure that your heirs, other family members, friends, and anyone else included in your will is taken care of after you die. An estate is someone’s last legacy, and if you’ve written up a will, you’ve made a wise choice. But you need to make sure you update it to keep its contents relevant and in accordance with your evolving preferences. And if you’ve been named in a will, and that generous someone in your life has just passed away, it’s just the beginning of a long, complicated (and expensive) process. You don’t have to ride this out alone. Get in touch with our team at the Law Group of Iowa for steadfast support and experienced legal guidance. Call today to get set up with a free consultation.

Table of Contents

- Your Dedicated Wills Lawyer

- Exploring Estate Law in Iowa

- What Not to Do When Writing a Will

- Des Moines Wills Infographic

- Des Moines Wills Statistics

- Des Moines Wills FAQs

- Law Group of Iowa, Des Moines Wills Lawyer

- Contact Our Des Moines Wills Lawyer Today

When You Should Update Your Will

Too many people establish a will and never look at it again. This is a mistake. Your life circumstances are likely to change over time. When this happens, it is necessary to take another look at your will. Otherwise, your will might not reflect your current wishes. Below are a few signs that you need to update your will as soon as possible:

- Your financial situation has changed. If you receive a large inheritance or accumulate assets that significantly improve your financial situation, you will want your will to reflect that. After all, you want your beneficiaries to have access to all of your assets after you are gone.

- You are planning to get divorced. If you are thinking about getting a divorce, you should update your will before you officially file. If you die suddenly without completing your divorce, your spouse will have rights to your assets.

- A beneficiary has substance abuse problems. It can be shocking to discover that one of your beneficiaries has developed a substance abuse problem. One of the next steps you should take is to make the appropriate changes to your will. Your beneficiary might not be able to think clearly and make the wrong decisions with his or her inheritance. You may want to add a trust that allows a third party to distribute money to your beneficiary under certain circumstances.

- You moved to a different state. Not all states have the exact same estate planning laws. As such, if you move to a different state, you should update your will immediately. Otherwise, your will might no longer work the way you intended it to.

- Your relationships have changed. It is not uncommon for people’s relationships to change over time. If you no longer get along with the people named in your wills, such as your beneficiaries, executor, or guardian for your children, it is time to contact our wills lawyer in Des Moines, IA, and make the necessary changes to your will.

- You were diagnosed with a medical condition. If you recently found out that you have a serious medical condition, it is definitely time to have another look at your will. Our lawyer may advise you to appoint a healthcare proxy in case you lose the ability to make good decisions in the future.

Inside The Probate Process

Probate is – at its simplest – the process of authenticating and executing a will. It goes through a special court (probate court) and it’s how your assets are collected, divided, and distributed between your beneficiaries. However, it’s much more complicated than it sounds. First, there’s the matter of authentication: a will needs to be authenticated to make sure it’s not a forgery. Simple. Next, the executor needs to be named. The executor is the person who will be in charge of your affairs after you’ve died, and if they’re named in the will already, even better. Again, simple.

Once a will is authenticated and an executor is named, your assets need to be located. (A bond can be posted as an insurance policy in case the executor makes any costly mistakes, but it’s actually optional.) The value of the assets will need to be determined. Creditors need to be notified, and debts need to be paid off. Taxes need to be filed, and only then can the estate be divided. Simple. Simple. Simple.

Except it’s really not as simple as it sounds. If you look back at the steps of the probate process, it might seem straightforward. But you also need to remember that probate means everyone who wants to contest the contents of a will, can. The will’s authenticity? Someone can argue that it looks fake. The executor? Someone can contest who gets to be in charge of the estate. The value of assets, the debts to be paid – everything is up for debate, and before you know it, months (or even years) have passed.

If you don’t want this to be a huge problem for your family and friends after you die, it’s a good idea to get in touch with our estate planning attorney.

Exploring Estate Law in Iowa

Our Des Moines wills lawyer can explain how estate law is vital in ensuring the smooth transfer of assets and property upon an individual’s passing. Understanding the specific laws related to estate planning and administration in Iowa is essential for individuals and families seeking to protect their assets and provide for their loved ones. The following is a brief overview of Iowa law. For more detailed information, contact our firm.

Iowa Probate Code

The foundation of estate law in Iowa is the Iowa Probate Code, codified in the Iowa Code Chapter 633. This code outlines the procedures and regulations governing the distribution of a deceased person’s assets and the administration of their estate.

Wills And Intestate Succession

In Iowa, a valid will allows individuals to specify how their assets should be distributed upon death. If a person dies without a will (intestate), the state’s laws, specifically Iowa Code Chapter 633.211, dictate how their property is distributed. Understanding the implications of intestate succession is important, as it may not align with your wishes.

Probate Process

Probate is the legal procedure through which a deceased person’s assets are distributed and their estate is settled. In Iowa, probate proceedings generally occur in the county’s district court where the deceased person resided. The process can be complicated, involving identifying and valuing assets, paying debts and taxes, and distributing remaining property to heirs or beneficiaries.

Iowa Inheritance Tax

Iowa is one of the few states that impose an inheritance tax. This tax is levied on property received by beneficiaries or heirs after a person’s death. The amount of tax depends on the relationship between the deceased person and the beneficiary and the value of the inherited property. Proper estate planning can help minimize the impact of inheritance taxes.

Power Of Attorney

A power of attorney is a legal document granting another person the authority to make financial and legal decisions if you become incapacitated. In Iowa, the Power of Attorney Act (Iowa Code Chapter 633B) governs the use and execution of power of attorney documents. These documents are crucial for ensuring that your affairs are managed in the event of your incapacity.

Advance Healthcare Directives

Advance healthcare directives, such as living wills and healthcare power of attorney documents, allow you to specify your medical treatment preferences and appoint a trusted individual to make healthcare decisions on your behalf if you cannot do so. These documents are regulated under Iowa law (Iowa Code Chapter 144B) and provide guidance to healthcare providers and family members in critical situations.

Trusts In Iowa

Trusts are a valuable estate planning tool in Iowa, enabling individuals to manage their assets, avoid probate, and provide for specific beneficiaries. The Iowa Trust Code, found in Iowa Code Chapter 633A, governs the state’s creation, administration, and termination of trusts. Our Des Moines wills lawyer can explain the different types of trusts available.

Estate Tax In Iowa

Iowa imposes an estate tax on estates with a net value exceeding a certain threshold. This tax is separate from the federal estate tax and can significantly impact the distribution of assets to heirs. Understanding the estate tax laws in Iowa is essential for effective estate planning.

What Not to Do When Writing a Will

Avoiding mistakes when writing your will is vital. By discussing your situation with our wills lawyer, you can avoid making these common mistakes with your will.

- Attempt To Write A Will Without Legal Counsel

You should never attempt to produce your will without consulting the professionals at the Law Group of Iowa. If you’re not thoroughly versed in the rules and requirements for writing a will, you may not be able to create one that is legally binding. When you’re ready to work on your will, get in touch with our attorney first.

- Only Writing A Joint Will With Your Spouse

While it isn’t ideal to expect the worst, you never know when situations between you and your spouse might change. If one of you passes away before the other or you possess assets that aren’t jointly owned, issues may come up in the settling of the joint will later on. Furthermore, many states don’t actually recognize joint wills; it’s ideal to develop your own individual will with our Iowa estate planning law firm, and you can always include your spouse as a beneficiary.

- Excluding Your Pets

Your pets are technically considered property by the state, which means they count as an asset that will need settling in the event that you pass away. Consult with our wills attorney, to discover the best way to include your pets in your will. Doing so gives you the chance to designate a caretaker for them, preventing them from being transferred into state custody when you’re gone. If the pet is solely yours, it should be included in your individual will, not a joint will.

- Forgetting To Update Your Will Regularly

You may think that once you’ve written a will, you’re good to go and no further action is required. In fact, it’s important to regularly update your will, and you should have legal counsel when doing so. Nearly any wills lawyer in Des Moines, IA, will recommend that you update your will if your assets change significantly, or in the event of a birth, death or divorce. If you’re unsure when to update your will, you can always reach out to our legal team for more clarity.

- Altering Your Will Outside Official Legal Situations

It’s critical that you only alter your will with help from our lawyer, so don’t attempt to change the documents in any way without legal counsel. Whether you try to make content changes or otherwise decorate or dress up your will, you could potentially undo any legal binding it held.

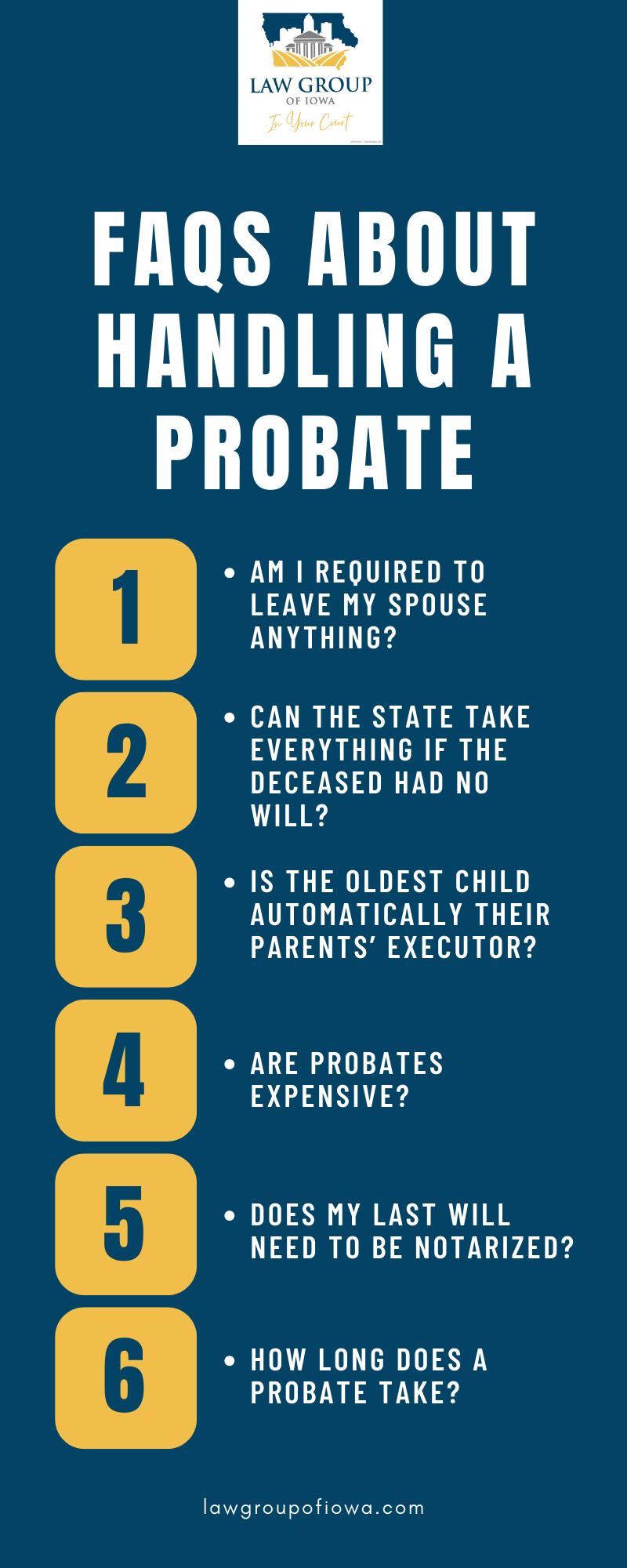

Des Moines Wills Infographic

Des Moines Wills Statistics

According to a caring.com 2022 wills survey, 56% of Americans believe that estate planning is important but 66% of adults don’t have a will in place. Here are some recent estate planning statistics:

- 32% of Americans have a will.

- 46% of will executors were aware of a will.

- 32% of adults under 35 said they wrote a will because of COVID-19 .

If you need an estate planning lawyer in Des Moines, IA, the Law Group of Iowa is the place to start. If you’re like many you know you should have a will so that your estate passes to the people, pets, and institutions of your choice, but you really don’t know much about wills.

Simply put, your will, which is also known as your ‘last will and testament,’ is a legal document you create or cause to be created declaring your choices about the distribution of your estate when you pass. If you don’t have one now, creating one will give you a certain piece of mind knowing that you’ve covered the basics.

Des Moines Wills FAQs

Am I Required To Leave My Spouse Anything?

You technically have no legal obligation to leave your spouse anything in your will – couples often choose to do this for a wide variety of reasons. This is perfectly fine as long as both parties continuously agree on the terms of the will. However, if the surviving spouse changes their mind after their partner passes away, they or may choose to contest the agreement and instead pursue the elective share of the estate.

Can The State Take Everything If the Deceased Had No Will?

If the deceased had no will, assets are divided between the next of kin. The Law Group of Iowa will usually start with a living spouse; if there isn’t one, they’ll move on to living children. The state can only take assets from the estate if no living relatives can be found.

Is The Oldest Child Automatically Their Parents’ Executor?

If a deceased parent designated one of their children to be the executor after they pass, the oldest sibling doesn’t have any say. However, if the parent did not name an executor, the state will approach a living spouse before anyone else took the job. If there is no surviving spouse, the state will then approach the children. This usually leads to one of two outcomes: either the children designate an executor amongst themselves, or they all opt to be co-executors in the will.

Are Probates Expensive?

Most probate cases don’t even require a proceeding. Those that do only account for around 5% of the estate’s value.

Does My Last Will Need To Be Notarized?

Whether a will needs to be notarized is up to each state, but it isn’t necessary in some cases. In places like California, a last will only need to be signed by the testator as well as two witnesses. Ask our estate lawyer for more information.

How Long Does A Probate Take?

The length of time it takes to settle probate can vary, but you can expect it to be at least a few months. It may take upwards of a year in some cases; for example, if the deceased has ongoing income after they pass away or a particularly large estate, dividing the assets may be more complicated. If the family frequently argues, it may take longer to finish the probate.

Wills Law Glossary

Creating and maintaining a valid will is a responsible step toward safeguarding your assets and protecting your family’s future. If you’re searching for a Des Moines, IA wills lawyer, it’s important to become familiar with some of the legal concepts that play a key role in estate planning. Below, we’ve defined five key legal phrases that are central to will creation, probate, and estate administration in Iowa. These terms can guide your understanding of the estate process and help you make informed decisions.

Last Will And Testament

A last will and testament is a legally binding document that communicates how a person wants their assets distributed after they pass away. It allows an individual, known as the testator, to name beneficiaries who will receive their property, designate guardians for minor children, and appoint an executor to carry out the instructions in the will. In Iowa, for a will to be valid, the testator must be at least 18 years old and of sound mind, and the will must be signed in the presence of two competent witnesses. Without a will in place, the estate is considered intestate, and state law dictates who receives the property.

Maintaining an up-to-date will is critical, especially when life circumstances change—such as marriage, divorce, or the acquisition of significant assets. If a will is outdated, its terms may no longer reflect the testator’s true intentions.

Probate Court

Probate court is a specialized court that oversees the administration of a deceased person’s estate. If the deceased left a valid will, the court’s role is to validate it and authorize the executor to carry out the instructions. If there is no will, the court follows state intestate succession laws. The probate process in Iowa includes several steps: validating the will, locating and valuing assets, paying any debts and taxes, and distributing the remaining property to the rightful beneficiaries.

While probate might seem straightforward, disputes can delay proceedings. Challenges may include disagreements over the value of assets, contested executorship, or questions about the will’s authenticity. Because probate can take months or even years, especially when contested, having a lawyer involved early can streamline the process.

Executor Of Estate

The executor of estate is the person responsible for handling the administrative duties after someone passes away. These tasks can include gathering and protecting estate assets, notifying creditors, paying debts, filing necessary tax documents, and ensuring that beneficiaries receive what they’re entitled to under the will.

In many cases, the testator will name the executor in the will. If no one is named—or if the named person cannot serve—the probate court will appoint someone. Executors have a fiduciary duty to act in the best interests of the estate and its beneficiaries. This role can be time-consuming and requires careful attention to legal responsibilities. Iowa law allows executors to request compensation for their work, which is usually paid from the estate.

Intestate Succession

Intestate succession occurs when a person dies without a valid will. In this situation, Iowa’s laws determine how the deceased person’s property will be distributed. Generally, the assets are passed to close family members in a specific order—starting with a surviving spouse and children, then moving to other relatives such as parents or siblings.

This process may not align with what the deceased person would have intended, which is why having a legally valid will is so important. Iowa’s intestate succession rules are outlined in Chapter 633.211 of the Iowa Code and apply unless a will or trust says otherwise. If no living relatives can be found, the estate could eventually become property of the state.

Advance Healthcare Directive

An advance healthcare directive is a legal document that outlines a person’s medical preferences in the event they become incapacitated and unable to communicate. This often includes a living will, which details decisions such as the use of life-sustaining treatments, and a healthcare power of attorney, which names someone to make medical decisions on the individual’s behalf.

In Iowa, these directives are governed by Iowa Code Chapter 144B. They are an essential part of a comprehensive estate plan, especially for individuals diagnosed with serious medical conditions or those who want to clarify their end-of-life care wishes. Including these directives along with your will can help loved ones make decisions with confidence and reduce the risk of disputes.

If you’re preparing your estate documents or reviewing an existing will, it’s helpful to consult with a firm that understands your goals. We at the Law Group of Iowa are here to assist with wills, probate, and estate planning. We work closely with clients to develop clear, valid documents that reflect their intentions and reduce uncertainty for their families.

Speak with our legal team today to schedule a consultation and find out how we can assist with your estate planning needs.

Law Group of Iowa, Des Moines Wills Lawyer

5601 Hickman Rd. Suite 3B Des Moines, IA. 50310

Contact Our Des Moines Wills Lawyer Today

At Law Group of Iowa, we understand that the probate process can be challenging, frustrating, and bitter, and we know that having a concrete will is the best way to avoid as much trouble as possible for your beneficiaries. Many people might think that their will is final, but unless it’s been properly prepared, there’s always the potential for infighting – at a time when people should be grieving and caring for each other, no less.

Don’t leave anything up to chance. Reach out to our qualified Des Moines wills lawyer, and see how the Law Group of Iowa can help you.

Google Review

“I was impressed with the professionalism demonstrated by Tom…his direction and guidance were deeply appreciated…concluding with a generous verdict in our favor…double dancing thumbs up!!” – Thomas S.