Lifelong Estate Management for Des Moines Families

When seeking a Des Moines, IA estate planning lawyer, it’s important to work with professionals who understand the unique aspects of Iowa law that affect your estate. At the Law Group of Iowa, we provide personalized estate planning services tailored to your specific situation and goals.

Why Estate Planning Matters

Estate planning is more than just creating a will. It’s a comprehensive approach to managing your assets during your lifetime and determining how they’ll be distributed after your death. Without proper planning, your assets may not go to your intended beneficiaries, and your estate could face unnecessary taxation and probate costs.

Our Des Moines, IA estate planning lawyers work with clients from all walks of life, not just those with substantial wealth. Everyone benefits from having clear instructions about their healthcare wishes, financial affairs, and asset distribution.

Wills and Trusts

A will serves as the foundation of most estate plans, directing how your assets should be distributed. However, a will alone often isn’t sufficient for comprehensive estate planning. Trusts offer additional benefits, including probate avoidance, potential tax advantages, and greater control over how and when beneficiaries receive assets.

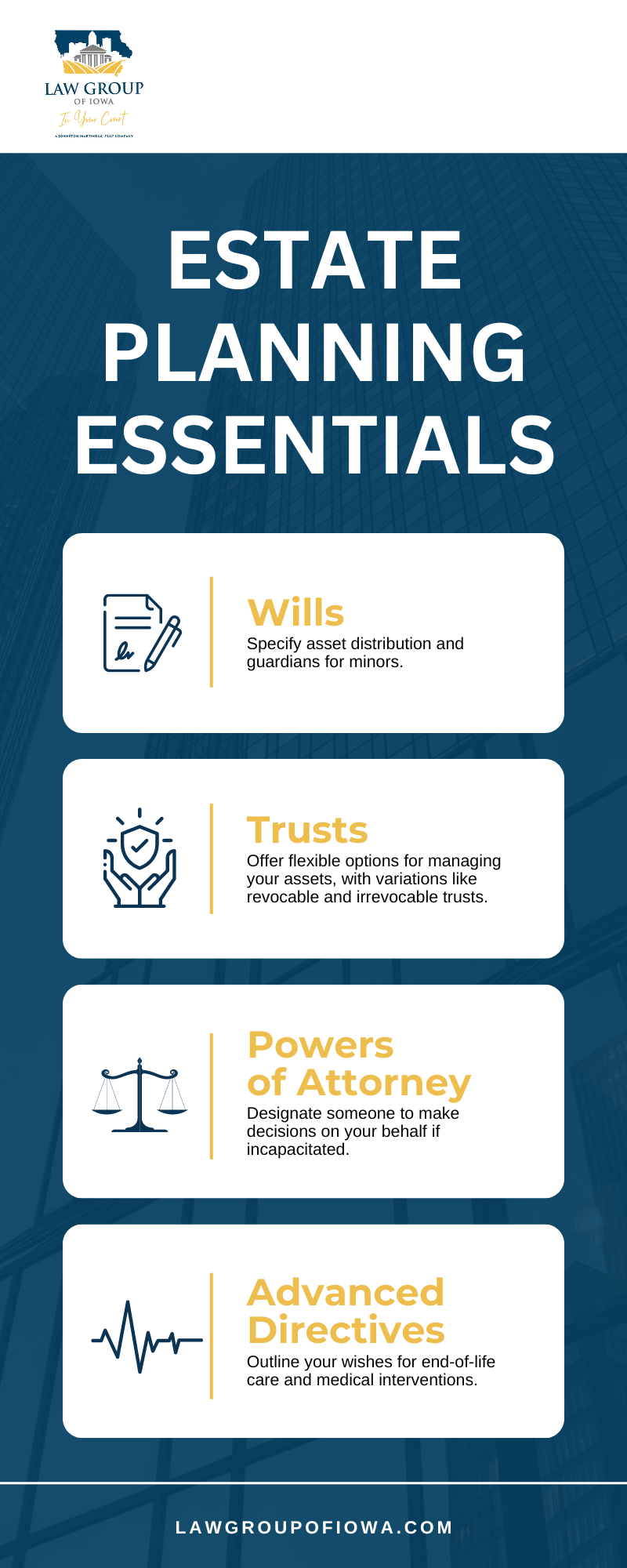

Wills

A will is a legal document that states how you want your assets to be distributed after your death. In Iowa, anyone who is at least 18 years old and of sound mind can create a will. A will must be in writing and signed by the testator (the person making the will) and two witnesses. The witnesses must be at least 18 years old and of sound mind.

Trusts

A trust is a legal arrangement in which you transfer ownership of your assets to a trustee. The trustee then manages the assets and distributes them according to the terms of the trust agreement. There are many different types of trusts, but some of the most common types in Iowa include:

- Revocable trusts: Revocable trusts can be changed or amended at any time before the grantor’s death.

- Irrevocable trusts: Irrevocable trusts cannot be changed or amended once they are created.

- Testamentary trusts: Testamentary trusts are created in a will and go into effect after the grantor’s death.

- Living trusts: Living trusts are created during the grantor’s lifetime and can be used to manage assets and provide for the grantor during their lifetime and after their death.

We can help determine whether a revocable living trust, irrevocable trust, or specialized trust structure would benefit your situation.

Powers of Attorney

Power of attorney documents allow you to designate someone you trust to make decisions on your behalf if you become unable to do so. Financial powers of attorney cover property and financial matters, while healthcare powers of attorney address medical decisions.

Advance Healthcare Directives

These documents communicate your wishes regarding medical treatment if you become unable to express those wishes yourself. They can include specific instructions about life-sustaining treatments and comfort care preferences.

Iowa Estate Planning Laws

Estate planning in Iowa encompasses various components, including wills, trusts, and understanding state-specific tax implications. For instance, Iowa’s estate tax exemptions and the importance of legal documentation like wills and trusts highlight the need for professional guidance. Tailored estate planning considers these elements, ensuring your plan aligns with Iowa laws and minimizes tax burdens on your heirs.

Initiating Your Estate Plan

Beginning your estate planning journey involves selecting a knowledgeable attorney in Des Moines. Look for firms with a strong reputation, like the Law Group of Iowa, offering no-cost consultations to understand your goals and provide personalized advice. Our experience in elder and business law further enhances the planning process, addressing all facets of your estate.

Choosing Between Wills and Trusts

Deciding whether a will or trust better suits your needs depends on various factors, including your assets, beneficiaries, and personal preferences. Both serve to direct the distribution of your assets but differ in their operation and application. Our experienced estate planning lawyer can guide you through the advantages of each, helping you make an informed decision.

Iowa Estate Taxes

Iowa has an estate tax, but there is a large exemption. In 2023, the Iowa estate tax exemption is $1.2 million. This means that estates valued at up to $1.2 million are not subject to Iowa estate tax. If the value of your estate exceeds the Iowa estate tax exemption, your heirs will have to pay estate tax on the amount over the exemption. The Iowa estate tax rate is 10%.

Estate Planning Terms to Know

-

- Will

A will provides instructions for distributing your property after death. This legal document names an executor to manage your affairs, beneficiaries who receive your assets, and potentially guardians for minor children. While wills must go through probate court, they remain a fundamental estate planning tool for most individuals.

- Trust

A trust creates a legal arrangement where a trustee holds and manages assets for beneficiaries. Trusts offer privacy and typically avoid probate proceedings. Both revocable trusts (modifiable during your lifetime) and irrevocable trusts (generally unchangeable after creation) serve different planning purposes depending on your objectives.

- Power of Attorney

This document authorizes someone you trust to make decisions on your behalf. A financial power of attorney handles property and monetary matters, while a healthcare power of attorney addresses medical decisions. These documents become crucial if you become incapacitated and unable to manage your own affairs.

- Probate

Probate represents the court-supervised process of authenticating a will, paying debts, and distributing assets. Many clients work with our Des Moines, IA estate planning lawyer specifically to minimize probate involvement, which can be time-consuming and potentially expensive.

- Intestacy

When someone dies without a valid will, state intestacy laws determine who inherits assets. These default rules may not align with your wishes, making proper estate planning essential for maintaining control over asset distribution.

- Executor

An executor (sometimes called personal representative) administers your estate after death. They inventory assets, pay debts and taxes, and distribute property according to your will. Choosing a responsible, trustworthy executor significantly impacts how efficiently your estate gets settled.

- Living Will

Unlike a traditional will, a living will addresses healthcare decisions rather than property distribution. This document specifies your preferences for medical treatment if you become unable to communicate, particularly regarding life-sustaining procedures.

- Beneficiary Designations

Certain assets like retirement accounts, life insurance policies, and financial accounts allow you to name beneficiaries who receive assets directly, bypassing probate. These designations typically override instructions in your will, making them critical components of a comprehensive plan.

- Guardianship

For parents of minor children, naming a guardian represents one of the most important estate planning decisions. This designation provides court guidance about who should raise your children if both parents become unable to do so.

- Estate Tax

Federal estate taxes apply to estates exceeding certain value thresholds. While most estates fall below these exemption limits, larger estates may benefit from tax planning strategies our Des Moines, IA estate planning attorney can recommend.

- Gift Tax

The gift tax applies to transfers of property during your lifetime. Understanding annual exclusion amounts and lifetime exemptions helps maximize wealth transfer efficiency while minimizing tax consequences.

- Step-Up in Basis

Inherited assets often receive a “stepped-up” tax basis to their fair market value at the time of death. This adjustment can significantly reduce capital gains taxes when beneficiaries eventually sell these assets.

- Conservatorship

If someone becomes unable to manage their financial affairs without proper planning documents in place, a court may appoint a conservator to handle financial decisions. Comprehensive estate planning helps avoid this court intervention.

- Guardianship for Adults

Similar to conservatorship but focused on personal care rather than finances, adult guardianship proceedings become necessary when someone can no longer make or communicate responsible decisions about their own well-being.

Des Moines Estate Planning Infographic

Des Moines Estate Planning Statistics

According to a survey conducted by caring.com, even though 56 percent of Americans believe estate planning is important, only 33% have taken the steps to have end-of-life plans put in place. For those who do have an estate plan in place, 75% have drawn up wills, 20% have set up trusts, and 6% involved the naming of guardians for minor children.

Don’t take the risk that your estate will be eaten up in legal fees and court battles. Call our office to meet with our Des Moines estate lawyer.

Des Moines Estate Planning FAQs

Do I Need A Will?

Yes, plain and simple. Many people have a misconception about who needs to create a will. The truth is everyone should have one, not just wealthy, elderly people with contentious familial relationships. Traditionally considered assets like real estate and bank accounts are not the only things that can hold value. During times of grief, family squabbles can occur over anything. That can include high-value property, but it can also include your grandmother’s pasta pot or a recorded VHS tape of your 1995 summer vacation. To avoid the stress of indecision and fighting amongst surviving family members, reach out to our wills lawyer to discuss obtaining a will.

When Should I Create An Estate Plan?

Sooner is better than later. You likely already know that life is unpredictable, and being as prepared as possible for future inevitabilities is a good idea. Creating a will now give you and your loved one’s peace of mind. Illness and injury can occur at any age. Don’t wait until it’s too late. When you decide to take action on this important process, work with our knowledgeable estate attorney.

I Have An Estate Plan, Do I Need To Update It?

Probably. There is no set amount of time that you must update your estate plan, however, the general consensus is that a review should occur every three to five years. You should also consider making amendments anytime a major life event occurs. This can be a marriage, divorce, birth, adoption, move to a new state, or death of a beneficiary. You want to make sure your will or estate plan includes the most recent version of your wishes. The Law Group of Iowa can help you make adjustments to your current estate plan.

What Happens If I Die Without An Estate Plan?

A will or trust leaves important instructions behind for your family and friends, and if you don’t work with our lawyer to draft up these valuable instructions ahead of time, your family and friends will suffer for it. Arguing over inheritance has the potential to rip families apart and destroy relationships, and it can be extra stress on top of an already stressful situation: People are grieving, so chances are they aren’t totally thinking straight.

Additionally, if you’ve left behind a will but failed to leave proper instructions on who should be responsible for managing your estate, a probate court can choose an executor instead. This court-appointed representative is usually a spouse or other family member, but if your family has been fighting (or you had a demanding – and possibly vindictive – ex-wife or ex-husband), this can become a point of contention.

In these instances, probate (the process of managing and distributing your estate) can drag out for months, and even years. All the more reason to make sure you have the right estate planning lawyers helping you out before your death.

What Is An Estate Plan?

Simply put, an estate plan is a collection of legal documents that spell out exactly how you want your assets and liabilities to be handled after you die. In fact, trust can go further than that and include the details of how you want to be cared for when you fall seriously ill. These documents usually comprise a will, appoints an administrator for your estate, spell out advanced directives about your health care, grant powers of attorney, etc. The exact documents will depend entirely on your situation.

What you do want is to work with our experienced estate planning lawyers in Des Moines, IA. You want an attorney who not only knows estate law but has solid experience putting estate plans together for Iowa residents. We know the law and we’ve worked with many kinds of clients from those who have few assets to those who have assets not just in Iowa but all over the country and even the world.

Estate Planning Glossary

When working with our Des Moines, IA estate planning lawyer, you’ll likely come across terms that carry significant legal meaning and long-term consequences. These concepts form the foundation of estate planning, which involves preparing for the management and distribution of your assets after death or incapacitation. Understanding these key terms helps us make more informed decisions that reflect our wishes and protect our loved ones. Below are several common terms you may encounter when consulting with our lawyer.

Will

A will is a legally binding document that outlines how an individual wants their assets distributed after their death. It can also include instructions about guardianship for minor children, specific gifts to individuals or organizations, and funeral arrangements. A valid will must be written, signed by the testator (the person making the will), and witnessed by at least two people. Without a will, the state’s intestacy laws determine how property is divided, which may not reflect your actual wishes. A properly drafted will gives us the ability to maintain control over our legacy and protect those we leave behind.

Trust

A trust is a legal arrangement where one party, the trustee, holds and manages property on behalf of another, the beneficiary. Trusts can be created during a person’s lifetime or established by will after death. They serve various purposes such as avoiding probate, managing assets for minors or those with disabilities, and reducing estate taxes. A revocable trust can be changed or canceled by the grantor during their lifetime, while an irrevocable trust generally cannot be modified once it’s created. Trusts are often used to simplify the transfer of assets, offer greater privacy, and provide long-term financial planning tools.

Probate

Probate is the court-supervised process of validating a will and distributing a deceased person’s estate. This includes identifying heirs, paying off debts and taxes, and transferring property to beneficiaries. In cases where no will exists, probate involves applying Iowa’s intestate succession laws. The probate process can be time-consuming, potentially lasting months or even years, and typically involves public court records. For families, probate can add stress and cost during an already difficult time. Many estate plans are designed specifically to minimize or avoid probate through the use of trusts, beneficiary designations, and joint ownership.

Executor

An executor is the individual named in a will to carry out the instructions of the deceased. This role includes locating and managing estate assets, paying creditors, filing tax returns, and distributing remaining property to beneficiaries. If an executor is not named, the court will appoint someone to fulfill the same responsibilities, typically called an administrator. Executors have a fiduciary duty to act in the best interest of the estate and its beneficiaries, which means they must be honest, organized, and capable of handling complex tasks. Appointing a trustworthy and competent executor is one of the most important decisions in estate planning.

Advance Directive (Living Will)

An advance directive, commonly referred to as a living will, is a legal document that states a person’s preferences for medical care if they become unable to communicate. This may include decisions about life support, resuscitation, feeding tubes, and other end-of-life treatments. Some advance directives also allow for the appointment of a healthcare proxy, someone authorized to make decisions on your behalf. Our full-service legal firm at Law Group of Iowa can explain how this document provides clarity to loved ones and medical professionals during times of crisis, helping to reduce confusion and conflict. Including an advance directive in your estate plan is a critical step in preserving autonomy and reducing burdens on your family.

Law Group of Iowa, Des Moines Estate Planning Lawyer

5601 Hickman Rd Suite 3B, Des Moines, IA 50310

Contact Our Des Moines Estate Planning Lawyer Today

Creating a proper estate plan requires legal knowledge, attention to detail, and thoughtful consideration of your wishes and family dynamics. Working with qualified legal counsel helps avoid common pitfalls that could result in family disputes, unnecessary taxes, or court interventions.

Contact the Law Group of Iowa today to schedule a consultation with our Des Moines, IA estate planning lawyer. We can help create a personalized plan that addresses your specific needs. Your peace of mind and your family’s future security are worth the investment in proper planning now.

Read more of our Google reviews and let us know how we can help you with your estate plan.